Lessons from the last Brexit: behind the tears of Black Wednesday and the rise of George Soros eBook : Xie, Qian: Amazon in: Kindle Store

Contents:

Can you really engage into some kind of flouting of narratives? Can you dump information in this country which suits you and we will not be in a position to neutralize it? Anti dumping is a known mechanism in economics that a large industrial house in the world wants to nip in the bud growth of the sector in a particular country by dumping. If there could have been a dumping of 200,000 cars at the time with a much lower price.Similarly the dumping of informationŌĆ”we cannot compensate. For example, in a simple words I would say a devil canŌĆÖt be allowed to take aid of scriptures because in doing so, you are challenging our intellect that we are totally hoodwinked by your exercise which is sinister and aimed only to damage us. However, both these policies of protecting the value of the pound was aggravating UKŌĆÖs already serious economic downturn.

Trump live updates: Threatening letter with nonhazardous white powder found at Manhattan DA’s office – CNBC

Trump live updates: Threatening letter with nonhazardous white powder found at Manhattan DA’s office.

Posted: Fri, 24 Mar 2023 21:36:00 GMT [source]

Expressed concernabout the alleged https://1investing.in/ of authoritarianism in India and the ŌĆ£erosion of democratic institutionsŌĆØ under the government of Prime Minister Narendra Modi. Called him an ŌĆ£American MadmanŌĆØ and claimed Soros wanted to replace the ŌĆ£nationalist government in BharatŌĆØ with a ŌĆ£PappuŌĆØ. Could spark a democratic revival in India at an event Thursday. Another theme on the agenda is to focus on diverse perspectives from the Global South, which included some of the poorest and least industrialized countries in the world.

Before the introduction of the euro, change rates were primarily based on the European Currency Unit , the European unit of account, whose value was determined as a weighted common of the participating currencies. Treasury papers advised that if the federal government had maintained $24 billion foreign currency reserves and the pound had fallen by the identical quantity, the UK may have made a ┬Ż2.four billion revenue on the pound sterlingŌĆÖs devaluation. The political injury from Black Wednesday was a lot worse because the Conservative Party had recently won reelection on a professional-euro platform. Three weeks ago, almost nobody in India had ever heard of Hindenburg Research.

Just Trading

Although initial investigations found black wednesday george soros innocent and no charges were brought against him, the case was reopened a few years later. In June 2006, the French Supreme Court convicted Soros of insider trading, although it reduced the penalty to EUR940,000. Soros vehemently denied any wrongdoing, arguing that news of the takeover was public knowledge and that he had no insider knowledge of the business. Soros, who accused the Indian tycoon of financial jugglery, is himself a convict of insider trading.

- This costed the government and the taxpayers ┬Ż3.3 billion dollars and threw the entire British financial system into chaos.

- Druckenmiller then successfully managed money for George Soros for several years in his role as the chief strategist for the Quantum Fund between late 1988 to 2000.

- This was called Quantum Fund or Soros Fund which started taking money from clients.

And European governments concluded their deliberate integration was susceptible as long as it was depending on the ERM ŌĆō particularly because the episode had highlighted the BundesbankŌĆÖs reluctance to take motion in defence of the forex bands. SterlingŌĆÖs suspension from the ERM ensured the UK by no means entered the only forex ŌĆō whereas its devaluation paved the best way for a powerful restoration that ensured Labour inherited a powerful economic system when it got here to energy. Some economists now seek advice from it as ŌĆ£Golden WednesdayŌĆØ. At one level, sterling was buying and selling at $1.1348, a degree not seen since March 1985.

When did Britain join the ERM?

Let me tell you what happened in the year 1979 when the situation changed a little. Due to the difference and fluctuations in currencies, itŌĆÖs difficult to set prices of trades. So, the world came up with a term called Exchange Rate Mechanism . So, the European nations decided to make a range for all the other currencies. Investors are requested to note that Stock broker is permitted to receive/pay money from/to investor through designated bank accounts only named as client bank accounts. Stock broker is also required to disclose these client bank accounts to Stock Exchange.

- Socialism is a morality play, but the problem is that it doesnŌĆÖt actually produce anything.

- It additionally helped non-euro-area countries put together to enter the euro space.

- Other speculators additionally started betting towards the pound, whereas buyers sought hedges against a collapse in the trade rate.

- This immunity comes with a great responsibility and a deep sense of accountability.

The London markets have waited 18 long years already for the Bank of England to appear on their screens, and I suspect their wait will continue for some time yet. In particular, a country planning to intervene must demonstrate it has an intimidating stockpile of foreign exchange reserves, and the readiness to use it. And it is likely that there will be a need for exchange controls, certainly on short-term capital flows, whether permanently or from time to time.

All you need to know about the H3N2 virus that has claimed six lives in India

At its founding, Quantum Fund had $12 million in assets under management, and as of 2011 it had $25 billion, the majority of Soros’s overall net worth. While the Bretton Woods system kept the poundŌĆÖs exchange rate relatively stable in the decades after World War II, governments had trouble when the system broke up and oil prices zoomed in the 1970s. These conditions do not typically apply in Western countries. The Swiss have large reserves, but are so interlinked with global capital markets that exchange controls are not a realistic option. Most other Western countries, certainly the US and the UK, are in no position to invest heavily to maintain a particular exchange rate.

Soros, for a long time, has been criticised for using his personal fortune as a tool to manipulate the democractic process in different countries. The authorities hoped to alleviate the selling stress by creating more shopping for pressure. During an excessive appreciation or depreciation, a central financial institution will normally intervene to stabilize the currency. Thus, the change rate regimes of floating currencies may more technically be often known as a managed float. A central financial institution might, for instance, permit a forex worth to float freely between an upper and decrease bound, a worth ŌĆ£ceilingŌĆØ and ŌĆ£floorŌĆØ.

Livermore began his career as a ŌĆ£boy plungerŌĆØ on the trading floors of the Boston Stock Exchange, where he quickly gained a reputation as a skilled and successful trader. In 1907, at the age of 25, he made a fortune by short-selling stocks during the Panic of 1907. He repeated this feat during the Panic of 1910, and by the age of 30, he was a millionaire several times over.

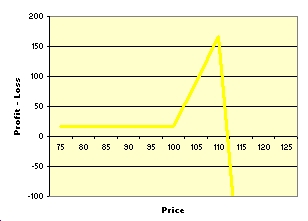

Was going to leave the European ERM on the day of black Wednesday. George Soros, founder of Soros Fund Management LLC, is a billionaire trader with an estimated net-worth of $8.30 billion. He is popularly known as ŌĆśThe man who broke the Bank of EnglandŌĆØ after he earned a profit of more than $1 billion in a day by shorting the British Pound during the 1992 Black Wednesday UK currency crisis.

Join Hindustan Times

George Soros, the 92 YO billionaire philanthropist and political activist, has been at the center of several controversies over the years. Soros claimed that Bush was guided by a “supremacist ideology" and presumably to fight this so-called “supremacist ideology", Soros spent millions of dollars. Most of the money was directed to 17 battleground states/ swing states. “By repudiating Bush’s policies at the polls, America will have a chance to regain the respect and support of the world," he reasoned. George Soros uses the Open Society Foundation, which was founded in 1993, to inject his influence into different nations. Estimates suggest that to date, Soros has deployed nearly USD32 billion to the Open Society.

In 1925, Chancellor Winston Churchill returned the pound to the gold standard at its pre-World War I level, ignoring warnings from John Maynard Keynes that it would overvalue the currency. The decision, which crippled UK exports and pushed up unemployment, was reversed six years later. Investors greeted BrownŌĆÖs 1997 announcement by snapping up long-term bonds on bets that inflation would remain under control. The yield on 10-year government bonds, 7.66% just before the election, fell about 30 basis points on the day of BrownŌĆÖs announcement. ŌĆ£This was the right thing to do, and is one thing Brown did that will last,ŌĆØ says Michael Saunders, chief Western European economist at Citigroup in London. Adani Group has been accused by US short seller Hindenburg Group of engaging in ŌĆ£brazen stock manipulation and accounting fraudŌĆØ over decades, a claim that Adani Group has stoutly denied.

Trump, turning up heat, raises specter of violence if he is charged – Hawaii Tribune-Herald

Trump, turning up heat, raises specter of violence if he is charged.

Posted: Sat, 25 Mar 2023 10:05:00 GMT [source]

High-interest rates at one point reached 15 per cent particularly hitting the housing market hard. With rising rates, mortgage repayments became unaffordable and default rates increased. Combined with rising unemployment from the recession it only made conditions worse. To do this, the governments needed to promote the strongest currencies and buy the weakest ones to keep rates consistent with their targets. Black Wednesday was extensively condemned as a large waste of cash on the time. It also damaged the reputation of British Prime Minister John Major and the Conservative Party for effective financial management.

This foundation acts as a grantmaking network to push Soros’ personal political goals. It happened on the Black Wednesday, where Soros entered like Thanos in the Avengers movie, and forced the British Pounds to leave ERM ŌĆō an early form of Euro. We donŌĆÖt want those people who donŌĆÖt engage in debate, dialogue, discussion and deliberation in the temples of democracy.